1️⃣ Building 👷🏻 TUCKEDito's Framework: Intro & Financials 📈

How did we start? Well this post will detail what we did over an eight month period, while working our full-time jobs, to build the framework of our business. This is post number 1 of.....I don't know, I guess we'll see.

By: James

How did we start? Well this post will detail what we did over an eight month period, while working our full-time jobs, to build the framework of our business. This is post number 1 of.....I don't know, I guess we'll see.

I'll use the timeline that's the header image. We extended the timeline a bit because we stayed at our jobs a little longer than expected.

💬 In This Post:

- I'll just go over how each step in the timeline was completed.

- I'll include notes that we took during our time starting up, that haven't been touched since.

- ☝🏻Purpose of the notes: These notes will help to show our thought processes during the early stages.

- ☝🏻Content of the notes: general thoughts, pictures, websites we used, conversations we had with business owners, books we read, etc.

- Commentary on these note to explain the importance and the "why" behind them

Let's Get Started

Sales Projections

This probably didn't need to happen as early as it did, but I'm interested in numbers so I was eager to start.

From my college business courses and learning I'd done on my own, I had a basic understanding of what the financials should look like. To project our financials I determined I needed to estimate cost of goods and sales to see our estimated margins.

So how did I go about getting there?

My thought process was something like 👇🏻

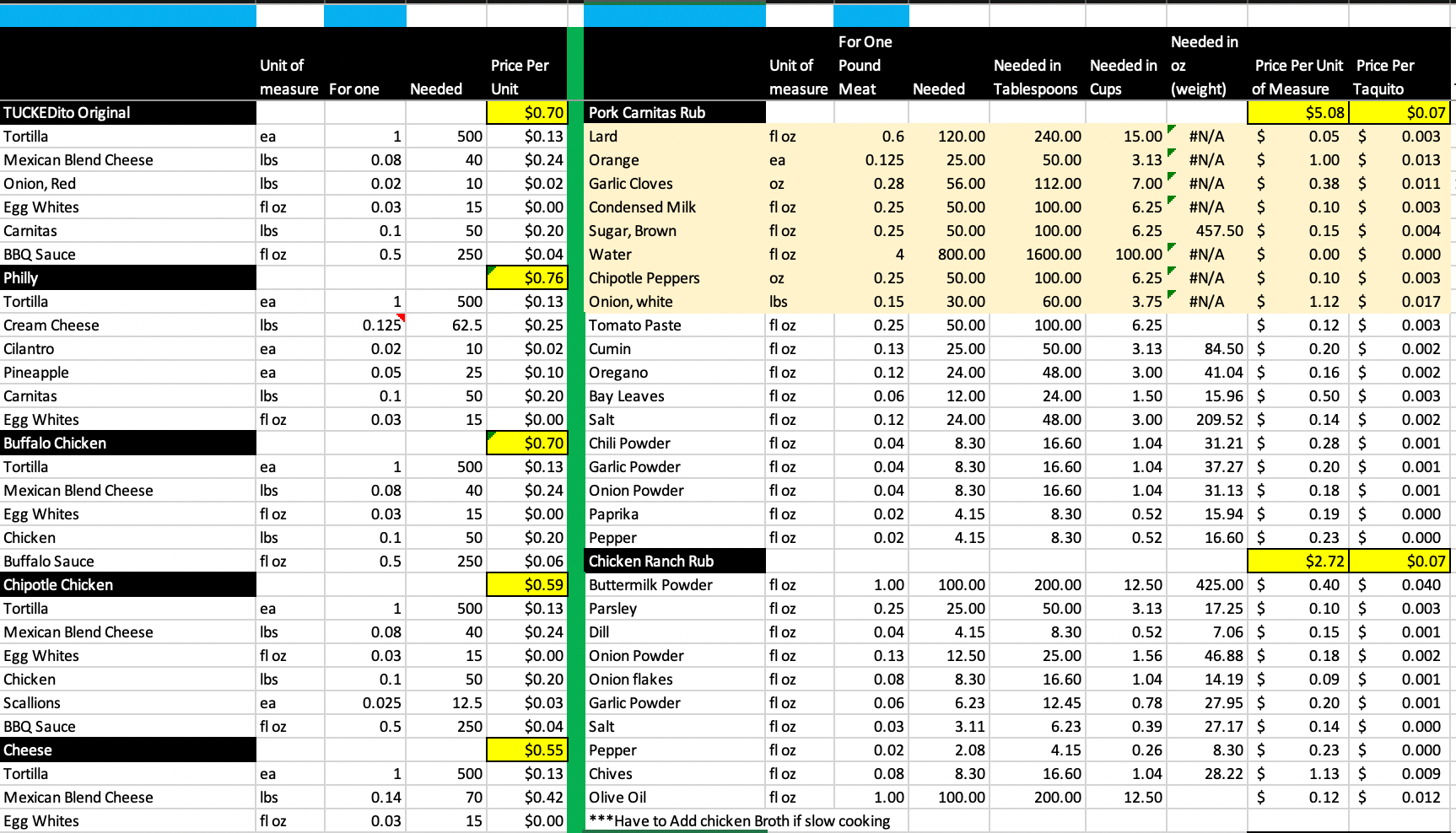

- List every ingredient, with the quantity of each, for each flavor taquito.

- Figure out how much all these ingredients cost.

- Based on this cost what would be a fair sales price?

- Now that we have a price and cost, how much money will we make per taquito

- How many taquitos will we sell per month? (this was a complete guess, I didnt consider capacity on our end and had no knowledge on what a normal amount of customers to see per day would be)

- Now that we have sales and COGS we have our gross profit

This got me through the projections, then it was into the financial statements.

That thought process looked like this 👇🏻

- Ok, I know I need cash flows, balance sheet, and income statement.

- What will each include?

- Well...what are our expenses, both start up and recurring?

- What will our sales and assets look like?

- How can I link them all together so that changes made are shown across the board?

Ok now that you have an idea of the thought process, here is a break down of it. I have all the excel pages for each and I included some commentary.

Cost of Goods

I listed the flavors and basic ingredients that we had up to that point. (Looking back on it now, I see a lot has changed.)

I listed all the flavors with the ingredients and the unit of measure. I knew the pork and chicken would be cooked in batches and then used in the taquitos.

I needed to figure out what it would cost to cook a batch of each and then add that into the taquito cost.

I gathered prices for all my raw materials.

Where'd my prices come from?

Well, I just googled each item and took whatever bulk pricing I found. Then I broke it down to price per unit of measure.

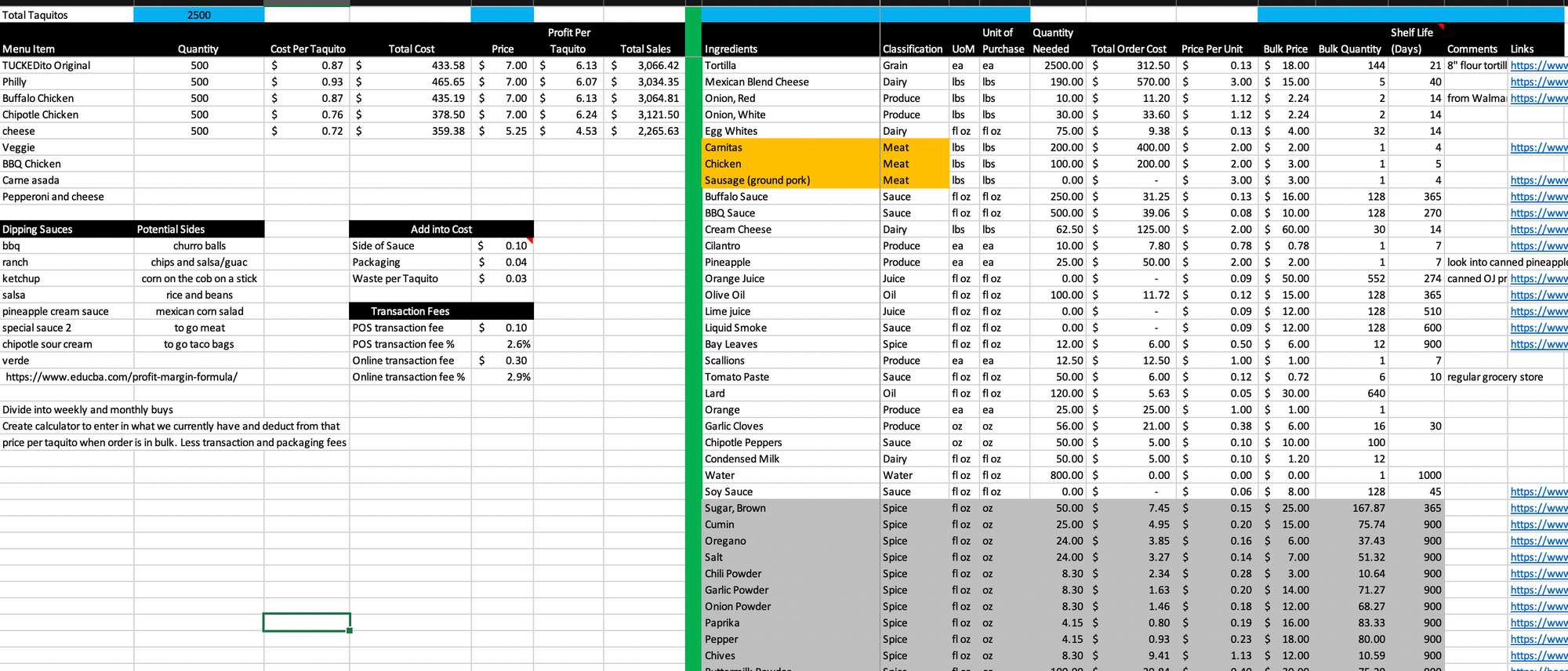

I connected the "raw materials quantity" page with the sales unit projections (you'll see this down in the next section👇🏻) so that when updated, it'd reflect how much we needed to make if projections changed.

Sales Projections

These were pretty much all guesses. At this time I hadn't really talked to anyone in the industry. Grade would be like a C-.

I assumed 3% monthly growth. I didn't take seasonality into consideration at all which I now know is a huge factor in this industry.

Selling 25 tshirts a month? Ya know what I think about that now? Pssshhh wishful thinking! haha. All the merch sales numbers were insanely high.

So yeah, that was all prettttay wrong 😳

But, my direction was correct, I just hadn't learned what was normal for the business.

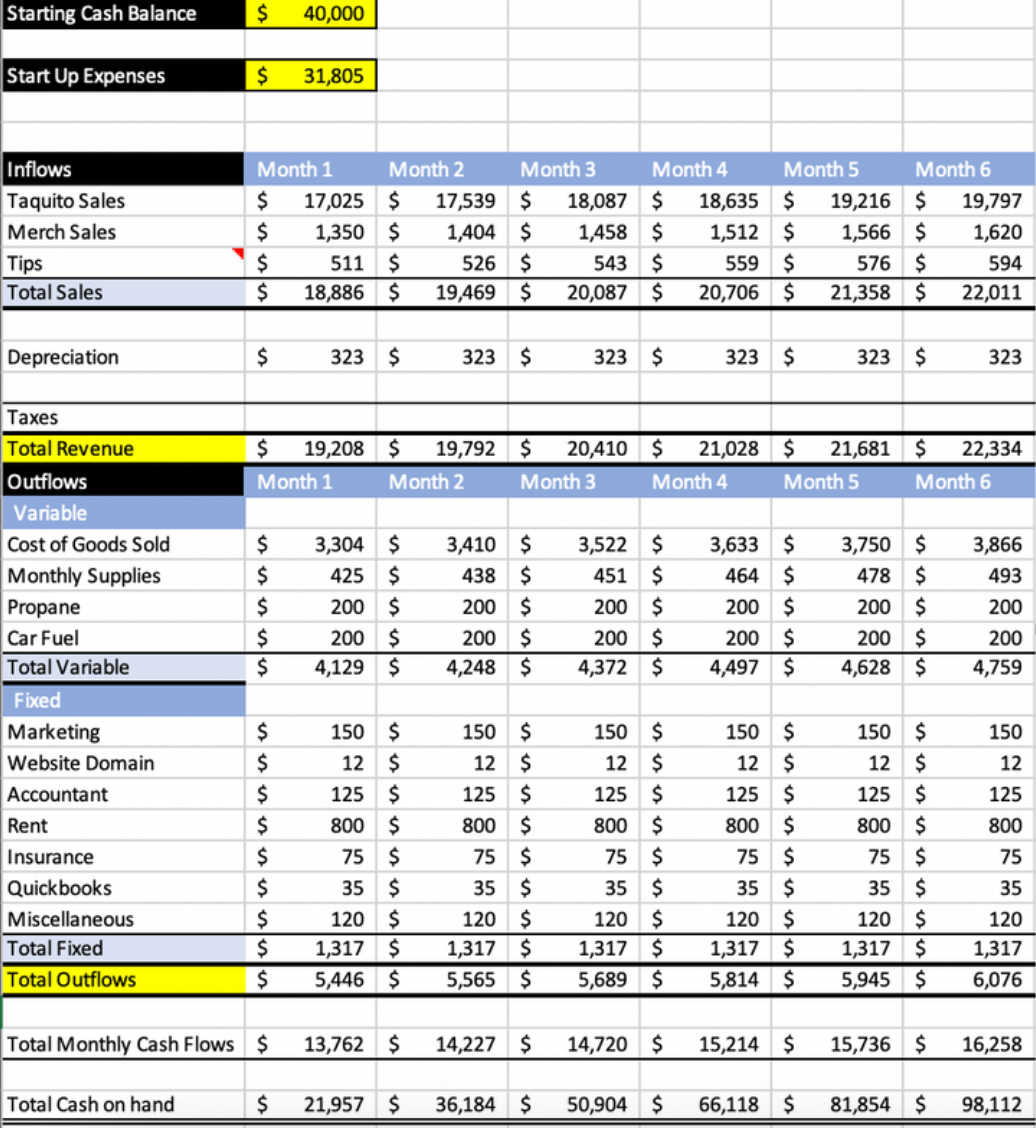

Cash Flow

Pretty good , expenses were a bit low but not too far off. I did fairly well here, maybe like a B-.

- The sales were too high, but we covered that earlier.

- Start up expenses were a little low.

- Fixed expenses should have been about double

- Variable expenses (which should have been labeled Direct Costs) should have been about 10% higher as a percentage of Sales.

- I did not include labor cost

All of those errors result in highly inflated monthly cashflows

But again... direction I was going was not terrible

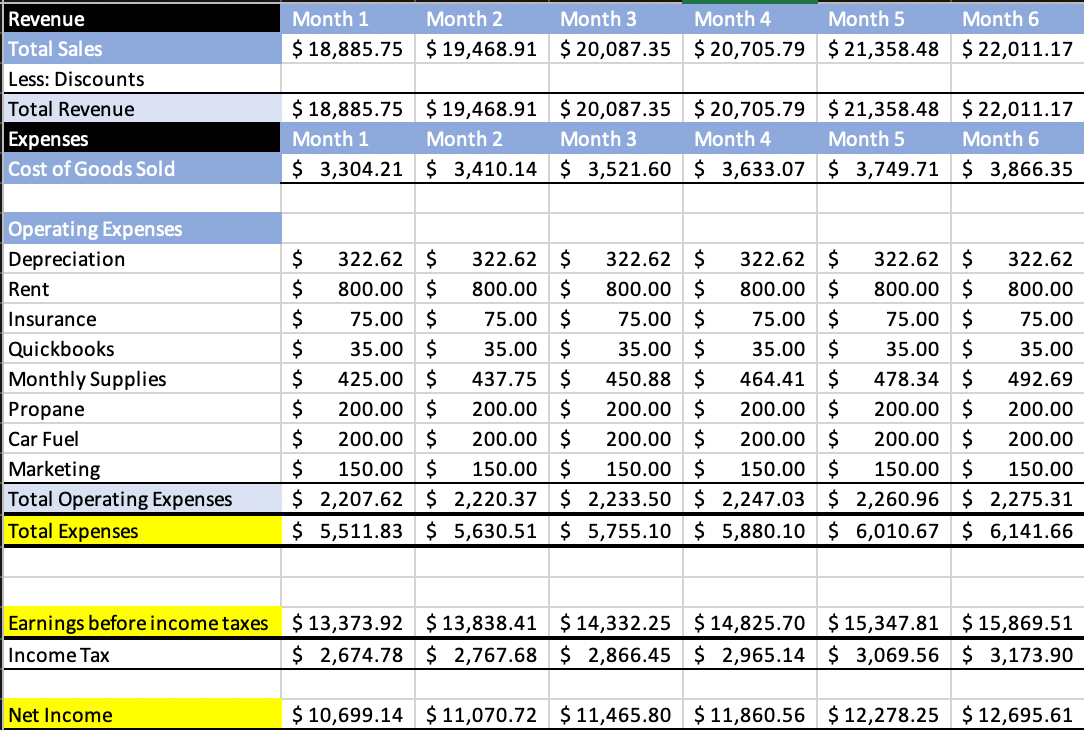

Income Statement

Another C- here. The main reason being the expenses differ from those on the cash flows statement. Cannot afford to have inconsistency.

The COGS was linked to the cashflows, which was good, but the operating expenses differed.

Because cashflows are too high, net income is looking a bit too high.

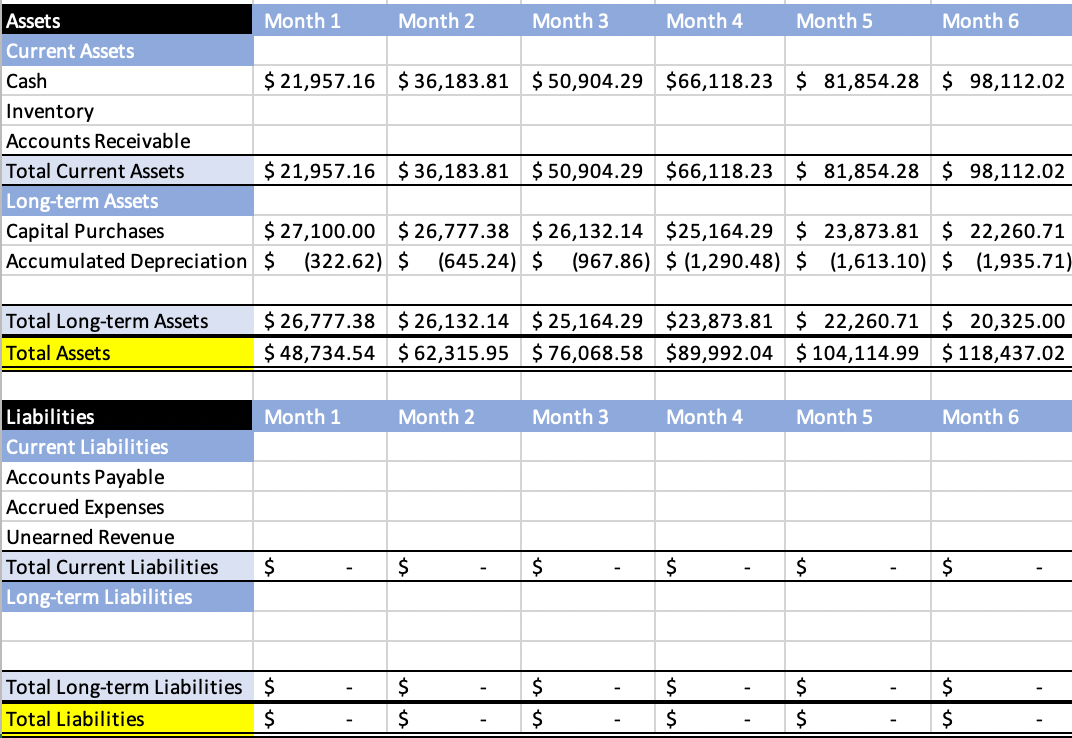

Balance Sheet

Grade: Incomplete. Haha no liabilities listed 🤦🏻♂️

This was done at a very high level. Cash account increases too much because of inflated profit numbers.

Also, about the lack of liabilities...

I guess maybe I was thinking we were going to buy our van in cash instead of taking out a loan?

That would have been dumb to do that so I'm glad we didn't. Assets are up in value since then, so that debt is cheaper than when we initiated it.

Want to Dive Deeper?

Here's the file if you want to check out all the formulas and stuff👇🏻